Electronic cigarettes have been gaining popularity in the United States. Still, the recently proposed ” Tobacco Tax Equity Act of 2023” may change the landscape. This bill aims to impose federal taxes on electronic cigarette products for the first time, sparking widespread discussions and concerns over its tax policies. This article will take a deep insight into the key aspects of the bill and its potential repercussions on smokers and public health and reasonable suggestions on how to handle it.

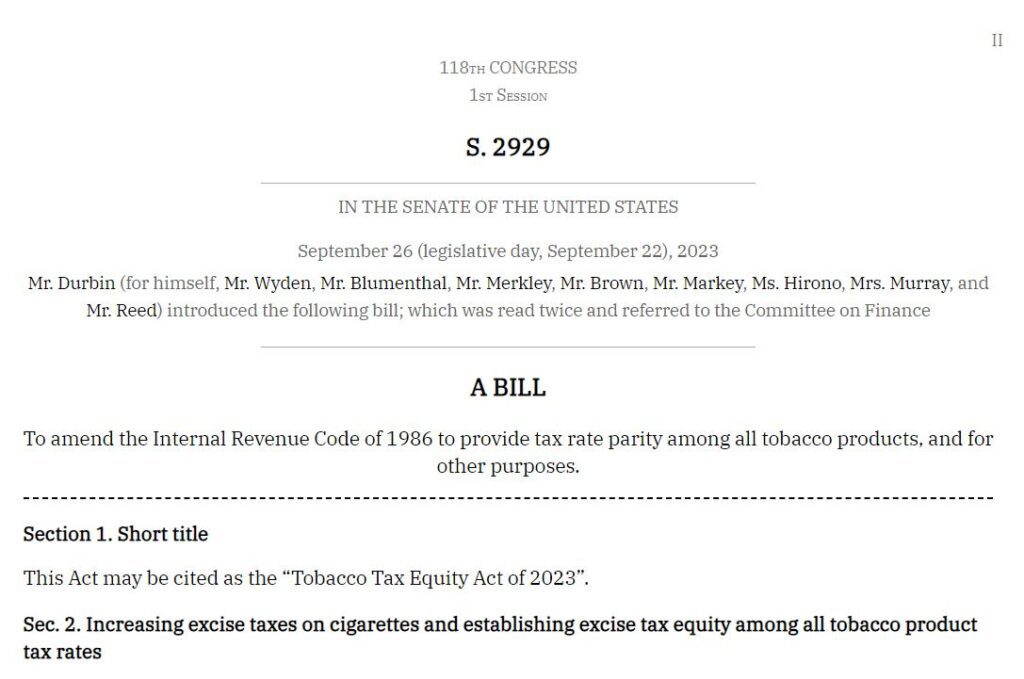

Tobacco Tax Equity Act of 2023 Overview

Starting March 31, 2023, the electronic cigarette market across the United States faces a significant transformation with the introduction of the “2023 Tobacco Tax Equity Act.” This bill seeks to implement a weight-based taxation policy on tobacco and nicotine products. If passed, it will double the federal tax on traditional cigarettes and substantially increase taxes on e-liquids, pipe tobacco, and moist snuff.

Senator Dick Durbin introduced the bill, with support from eight other Senate Democrats, on September 26. Senator Ron Wyden, one of the co-sponsors, emphasized, “It’s time to hold the tobacco industry accountable and save generations of teenagers.” However, this bill inevitably targets disposable vape and vape juice, etc, with a proposed fixed tax of $100 per 1,810mg of nicotine, which is concerning news for vapers.

Controversy and Opposition: Organizations and Institutions against the Bill

The bill has stirred controversy and opposition from various quarters. The Consumer Advocates for Smoke-free Alternatives Association (CASAA) is one of these organizations openly opposing the bill. Representatives argue that the senators supporting the bill display “willful ignorance about the tobacco risk continuum.” The CASAA website encourages smokers to email their senators to voice their views on the bill.

Electronic Cigarettes and Quitting Smoking: How Taxes Might Make a Difference

Vape products have become quite popular for people looking to quit smoking. But what happens if they become more expensive due to new taxes? Let’s break it down.

Imagine you’re trying to quit smoking, and you use a Juul vape pen. Right now, it’s cheaper than regular cigarettes. But there’s a new bill that could change that. This bill wants to put a big tax on electronic cigarettes. For example, if you have a Juul pod, it might cost $2.25 more in taxes, while regular cigarettes only have $2 in taxes. This means that nicotine from e-liquids and other sources could become much more expensive. Even nicotine pouches, which are supposed to be safer than regular cigarettes, would cost $2 more for a pack of 20, not counting local taxes.

So, here’s the thing: if this bill passes, it might make electronic cigarettes more expensive than regular ones. And that could make some people go back to smoking regular cigarettes. That’s why it’s essential to think about how taxes can affect people who are trying to quit smoking.

Action Plans for Electronic Cigarette Users and Sellers

For electronic cigarette users and sellers, this new taxation bill poses several challenges. However, there are strategies to help them navigate these changes effectively. Firstly, electronic cigarette users can consider the following actions:

- Stock Up on Backup Devices: In case vape products become more expensive, consider purchasing backup devices and consumables. This will make your vapes last longer and reduce the impact of higher taxes.

- Explore Smoking Cessation Alternatives: Explore alternative smoking cessation methods, such as nicotine gum, patches, or herbal therapies. These alternatives may be more cost-effective than e-cigarettes.

- Engage with Legislators: Get in touch with your local legislators to voice your opinions on the bill. Your input can potentially influence policy-making.

For vape store owners, you can also take specific actions:

- Diversify Product Lines: Consider expanding your product range to offer more smoking cessation products to meet the needs of ex-smokers.

- Educational Campaigns: Give your customers information and resources about quitting smoking. Help them understand there are other choices available.

- Engage in Industry Organizations: Become a part of organizations in the electronic cigarette industry. Together, you can address changes in policies and stand up for the industry’s interests.

Bottom Line

This debate isn’t just about taxes; it’s also about smoking and public health. We need to think about the differences between smoking and e-cigarettes and how tax policies can balance the need for money with keeping people healthy. E-cigarettes are seen as a valuable way to quit smoking. Still, they might not be as attractive if they become more expensive than regular cigarettes.

If the new bill by Durbin becomes law, we might see many smokers going back to regular cigarettes. By raising federal taxes significantly on e-cigarettes, e-liquids, and nicotine pouches, senators could be encouraging a whole generation to go back to smoking. So, we must carefully consider how tax policies affect public health and ensure both smokers and non-smokers are looked after. If you’re an e-cigarette user or seller, it’s important to plan for the future by using smart strategies.

Leave a Reply